For many taxpayers, navigating the complexities of tax forms can be daunting. However, the IRS W-9 printable form, Request for Taxpayer Identification Number and Certification, stands out for its role in ensuring the accuracy of information reported to the Internal Revenue Service. This indispensable document is often used when a person or entity needs to provide their taxpayer identification number (TIN)—which could be a Social Security Number (SSN) or an Employer Identification Number (EIN)—to another individual, financial institution, or company they are engaged in a transaction with.

The function of the printable IRS W-9 form is multifaceted: it is essential for compiling accurate 1099s, critical in reporting income paid to contractors, and necessary for certain financial transactions such as opening a new bank account. It is also used by real estate transactions to ensure proper reporting. Beyond these use cases, understanding the specifics of how to handle this document is crucial.

The Essential Checklist for Completing IRS W-9

- Verify Your Information

Double-check that your name and taxpayer identification number match those on your tax return. - Choose the Correct Tax Classification

Select the appropriate classification for your situation, whether you are an individual, C-corporation, S-corporation, partnership, trust, or estate. - Consistency with Other Forms

Ensure consistency across forms; discrepancies can lead to processing delays. - Address Update

If you've moved, provide your current address – this is where the requester will send your 1099 form. - Exemption Codes

Familiarize yourself with exemption codes; if they apply to you, include them on the form. - Signature

Don't forget to sign and date the form; an unsigned form is invalid.

Troubleshooting Common Form W-9 Errors

While completing the printable W-9 tax form may seem straightforward, errors are not uncommon. To ensure precision in submitting the request, it's important to acknowledge and avoid typical mistakes.

- Incomplete Forms

A common pitfall is submitting a form with missing information. Make sure to fill out all required fields fully. - Tax ID Errors

Incorrectly entering your TIN can create significant issues. Double-check this information before submitting. - Using the Wrong Form Version

Always use the latest version of the form to remain in compliance with the current tax laws. - Outdated Information

If your circumstances have changed (e.g., a name change), ensure the form reflects your current situation accurately. - Missing Certifications

The certification section is crucial, as it confirms the accuracy of the information you've provided; a missed signature renders the form invalid.

If you need to secure a copy of this essential document, you can print the W9 form for free directly from our website. Whether you're an individual freelancer, an independent contractor, or a business owner, having access to IRS Form W-9 printable PDF is a convenience that simplifies your tax preparation process.

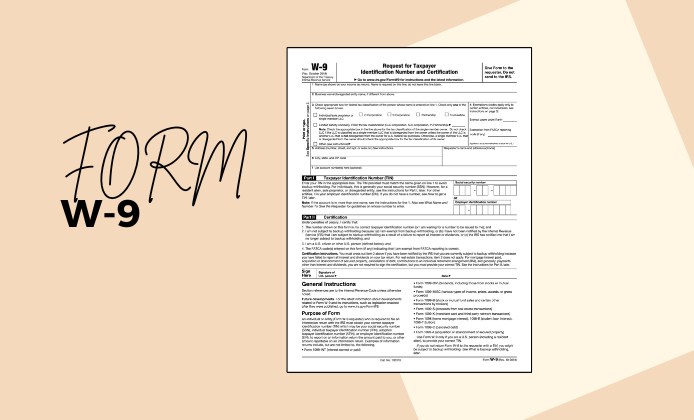

IRS W-9 Printable Form

IRS W-9 Printable Form

Fillable W-9 Form in PDF

Fillable W-9 Form in PDF