Understanding and handling tax documents is an essential part of financial transactions for both individuals and organizations. One commonly used document, known as the W-9 form, is a critical tool in this regard. Primarily, the W-9 request template serves as a means for collecting taxpayer identification information, which is necessary for reporting income paid to a contractor or vendor to the Internal Revenue Service (IRS). This information is vital for entities to comply with tax laws and avoid penalties for underreported earnings.

Our Website Benefits

Navigating the intricacies of the IRS W-9 tax form for 2024 need not be daunting. Helpful resources such as blank-w9-form.net offer an extensive library of materials that simplify this process. Our website offers a free blank printable W-9 form, along with detailed instructions. These resources enable users to confidently approach, understand, and execute the requirements of the W-9 form accurately and efficiently.

The W-9 Tax Form in 2024: Primary Terms & Exceptions

The blank Form W-9 for 2024 is frequently used in a variety of financial situations. Here are some specific transactions where its use is required:

- Independent contractors or freelancers may need to provide a completed W-9 form to clients to report earnings for services provided.

- Financial institutions might request a W-9 to open a new account or process certain transactions.

- Real estate transactions involving rent or mortgage payments often necessitate a W-9 from the payees.

The main reason why it's essential to fill out the IRS W9 form is because it ensures that businesses have the correct taxpayer information for the Internal Revenue Service, allowing them to issue accurate 1099-MISC forms for taxable payments. The 1099-MISC forms report to the IRS the amount paid to an individual or entity; the W-9 facilitates this by gathering the necessary taxpayer information.

To clarify the picture, here's a bullet list with exemptions for filling out and filing the form:

- Payments made to tax-exempt organizations generally do not require a W-9.

- Payments for personal (not business or trade) purposes also typically do not necessitate a W-9.

- If payments are made to foreign persons or entities, a document other than the free fillable W-9 tax form, such as W-8, may be more appropriate.

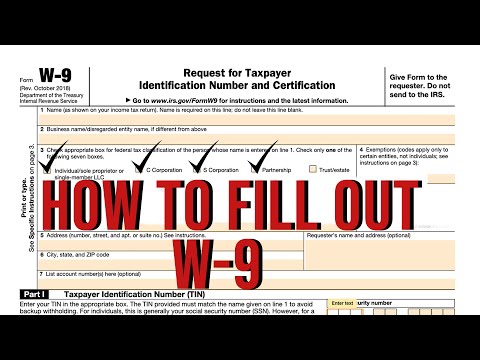

IRS W-9 Blank Form in PDF: From Filling to Submitting

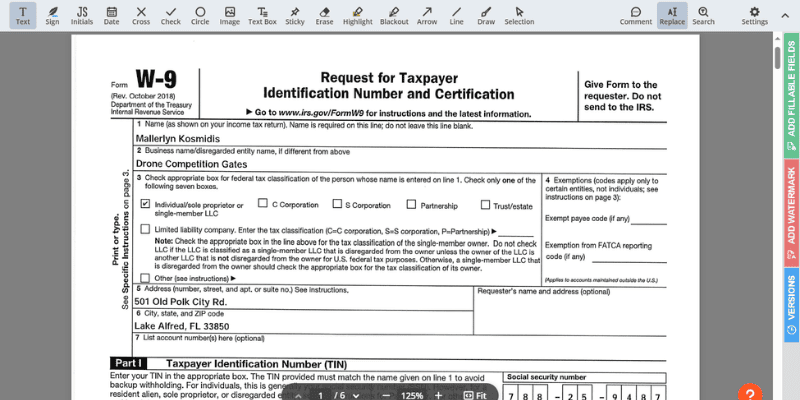

The blank, fillable W-9 form can seem complex, but by understanding its components, it becomes more approachable. Some main elements include the requester's information, TIN, and certification. Here are clear explanations for each field:

- Requester’s Information

This is the name and address of the individual or entity requesting the taxpayer's information. - Taxpayer's Identification Number (TIN)

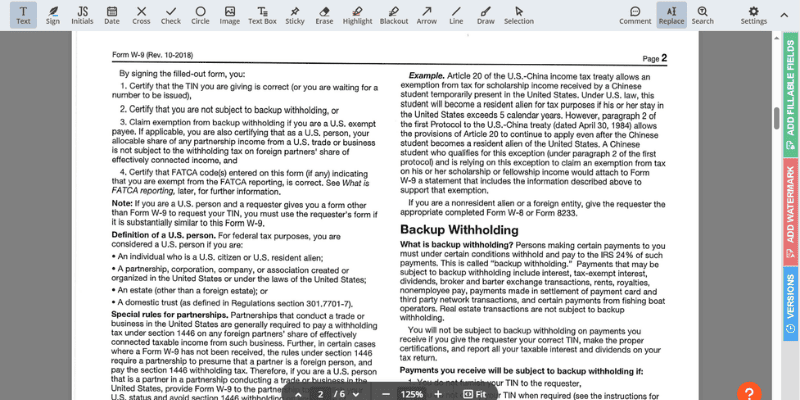

This can include a Social Security Number (SSN) for individuals or an Employer Identification Number (EIN) for businesses. - Certification

By signing the request, the taxpayer certifies that all provided information, including TIN and exemption codes (if applicable), is accurate.

Referring to a W9 form sample can greatly aid in visualizing how these components come together on the template to facilitate a deeper understanding.

Tips for Check the Federal Form W-9 Accuracy

It’s straightforward to print a blank W-9 form, but providing accurate information might not be so easy for first-time fillers. To aid in this process, these tips can be handy:

- Ensure that all information, particularly the TIN, matches official tax records.

- For individuals, input your name as it appears on your Social Security card.

- Businesses should provide the name used on their tax return alongside their EIN.

Using a free printable blank W9 form from reputable sources can considerably reduce errors by providing visual guidance.

Submission of IRS Tax Form W9 in 2024

The completion and submission of the IRS W-9 blank form do not adhere to a specific due date like annual tax returns. Rather, it should be filled out and provided promptly upon request from the party who requires this information for tax reporting. This immediate response ensures that reporting entities can meet their own filing deadlines and maintain compliance with IRS regulations. As for extensions, given that there is no set due date, the concept of an extension to complete this request is inapplicable. For updated versions of the request, consider searching for a downloadable W-9 form for 2024 to ensure the most current guidelines are being followed

Free Fillable W-9 Tax Form (2024)

Free Fillable W-9 Tax Form (2024)

Form W9 Instructions

Form W9 Instructions

Fill Out Blank W9 Form

Fill Out Blank W9 Form

IRS W-9 Printable Form

IRS W-9 Printable Form

Fillable W-9 Form in PDF

Fillable W-9 Form in PDF